Accola is an independent corporate finance boutique with an expertise in advisory and arrangement.

Financial Advisory

- Accola provides advisory services to mid and large sized corporations.

- As "financial architects" we are committed to assisting our clients in formulating and executing optimal financing strategies.

- Accola specialises in structured finance and particularly securitisation of the following asset classes:

- Trade receivables

- Operational and financial leasing

- Future rental cash flows

- Whole business securitisation

We support corporate in the implementation of securitisation programmes designed to expand their financing volume at more attractive financial conditions than the existing debt.

SECURITISATION

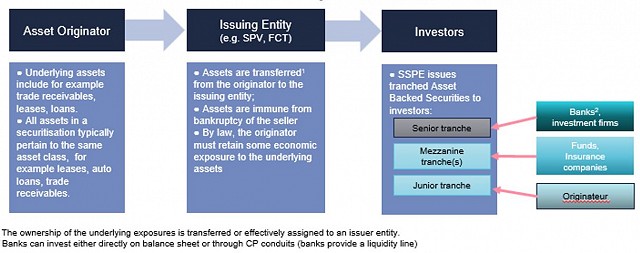

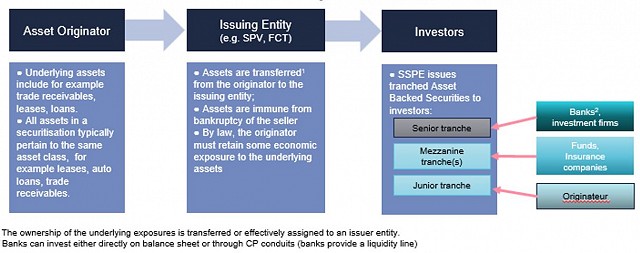

In securitisation, a company sells a portfolio of assets to investors by structuring them into tradable securities. Financial techniques are used to slice the portfolio, so that the securities issued carry a predefined degree of risk (e.g. senior, mezzanine, junior). Investors are compensated according to the risk inherent in each tranche.

Securitisation has many advantages:

- Flexible financing: the revolving nature of securitisation reduces the need for repetitive refinancing;

- Programs are structured to give the borrower the means to finance its growth.

- Securitisation allows companies to raise funds from diversified sources (e.g. a banking pool, institutional investors).

- Cost reduction: securitisation is cheaper than unsecured financing and often cheaper than other forms of secured funding.

- Off-balance-sheet treatment: in some cases, by removing securitised assets from the balance sheet, securitisation can help a company improve its rating and leverage ratio.

On the downside, securitisation is technically complex and requires the involvement of multiple players. Fixed costs are significant, although they can be amortised over time. As such, securitisation is effective if the volume of assets to be securitized exceeds EUR100M.

OUR OFFER

We bring you more than 30 years of experience in securitisation, on all types of assets (trade receivables, inventory, rent streams, future income) and in many jurisdictions. We act in your sole interest and are completely independent of other players in the sector (law firms, banks etc.).

WE HELP YOU:

- Analyze your assets (pool of receivables, inventories, rental cash flows or more generally future income)

- Define the optimal characteristics of your securitisation program (borrowing base, cost, revolving period, triggers, portfolio limits, ...)

- Draft the term sheet to be submitted to the banks;

- Our knowledge of the actors allows us to offer you to invite institutions outside your traditional banking pool

- Negotiate the best terms and conditions with banks

- Structure the program in line with the requirements of regulators (STS status) or auditors (IFRS deconsolidation in particular)

- Coordinate the various actors (funders, management companies, law firms, back up servicers, etc.).